Let’s discuss something that can make or break your business: retention rate. It’s the best gauge of whether your customers keep coming back for more. Happy customers equal a thriving business.

So, what exactly is retention rate? Simply put, it’s the percentage of customers who keep doing business with you over a specific period.

Let’s look at it closer, along with ways you can improve it.

What is retention rate?

Retention rate is a critical metric, especially in SaaS. It measures the percentage of customers who stick with your product over time. In many ways, it’s the pulse of your business.

A high retention rate means customers see value in what you’re offering. They’re engaged, loyal, and happy to keep paying for your product month after month.

Why does this matter? Because retention directly impacts your bottom line.

It costs 5 times more to acquire a new customer than it does to keep an existing one. Losing customers doesn’t just hurt revenue—it wastes the investment you made to acquire them.

On the flip side, improving your retention rate can have a massive impact on your bottom line. A 5% increase in retention can boost profits by 25-95%. That’s because retained customers tend to spend more over time, refer new business, and cost less to serve.

Improving your retention rate also helps with your company’s value. Studies show that just a 10% improvement in retention can boost the value of a company by 30%.

Retention is about keeping the customers you’ve worked hard to acquire. It’s not just about preventing churn—it’s about delivering ongoing value, building loyalty, and fostering long-term relationships.

Benefits of customer retention

The benefits of high customer retention are huge:

- More predictable revenue – A stable customer base makes forecasting easier.

- Lower customer acquisition costs – Retaining customers is far cheaper than constantly acquiring new ones.

- More referrals and word-of-mouth marketing – Happy customers bring in new ones.

- More upsell and cross-sell opportunities – Existing customers are more likely to buy more over time.

- Increased customer lifetime value – The longer customers stay, the more valuable they become.

Retention isn’t just a metric—it’s a growth strategy. The more you invest in keeping customers happy, the stronger and more sustainable your business will be.

How to calculate retention rate

Calculating your retention rate is actually pretty simple. All you need is some basic data about your customers over a given period.

Retention rate formula

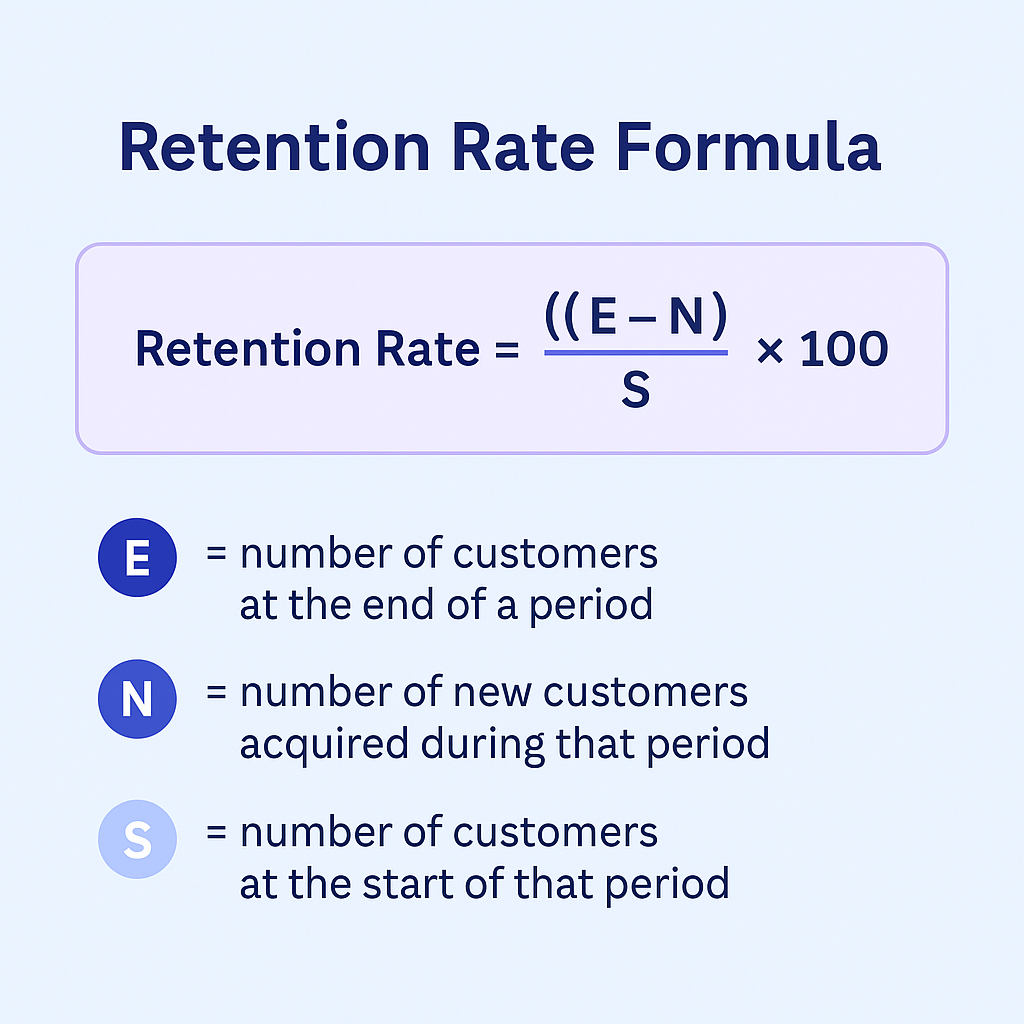

Here’s the formula for calculating retention rate:

Retention Rate = ((E-N)/S) x 100

Where:

E = number of customers at the end of a period

N = number of new customers acquired during that period

S = number of customers at the start of that period

Here’s an example.

Let’s say you start the quarter with 1,000 customers. Over the next 3 months, you gain 100 new customers but lose 50 of your existing ones.

That means at the end of the period, you have:

1,000 + 100 – 50 = 1,050 customers

Plugging those numbers into the formula, we get:

Retention Rate = ((1,050-100)/1,000) x 100 = 95%

In this case, the company has a quarterly retention rate of 95%, which is pretty darn good.

High vs. low retention rates

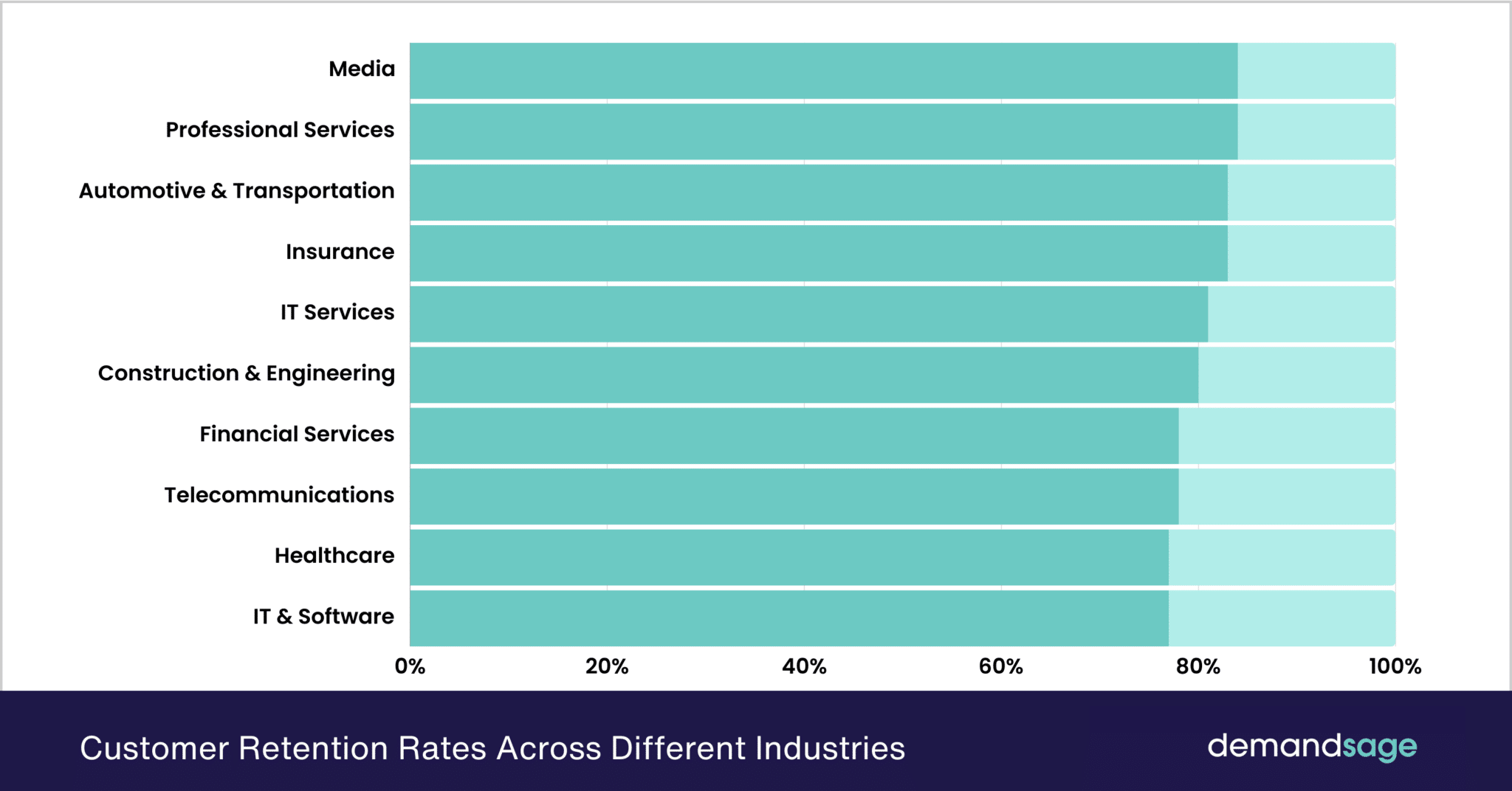

So what’s considered a “good” retention rate? It varies by industry, but in general, anything above 90% is world-class. It means your customers are sticking around for the long haul.

But if your retention rate is below 50%, that’s a major red flag. It means you’re losing a significant portion of your customers. That makes it much harder to sustain long-term growth. Unless your acquisition rate is extremely high, you’re facing a leaky bucket problem. That could cripple your business.

There are a couple other ways you can assess how well you’re doing:

1. Look at your historical rates — lets you quickly see if you’ve improved. Or, you can quickly spot a problem and investigate if your rate drops.

2. Look at industry rates — understanding where you stand relative to the industry lets you set realistic goals. Statista provides customer retention and churn rates by industry. This can be a useful reference point for how well you’re doing compared to similar businesses.

Factors affecting retention rate calculation

Keep in mind that several factors can impact your retention rate:

- The length of the time period you’re measuring (monthly vs quarterly vs annually)

- The type of business and industry you’re in

- The maturity of your product and customer base

To get started, benchmark your retention rate against similar companies. Then, track it over time to spot trends and areas for improvement. Make sure to choose an appropriate period to measure based on your business.

How to improve retention

Boosting your product’s retention rate isn’t just about keeping your current customers happy. It’s a strategic move that can significantly impact your bottom line. Here are actionable strategies to ensure your users stick around longer.

Identify at-risk customers

It’s critical to identify customers who may leave. Look for warning signs like decreased usage, low NPS scores, or negative feedback. Tools like Gainsight and ChurnZero can track customer health and flag potential churn risks. Once you’ve identified them, reach out directly—a quick check-in can often turn things around.

Proactively communicate with customers and address issues quickly

Maintaining open lines of communication is crucial for retention. Staying in touch helps keep your brand top of mind. You can do that through:

- Newsletters

- Social media updates

- Personalized emails

If you notice a drop in engagement, reach out proactively. When issues arise, quick resolution shows customers you care about their experience. Responsive support builds trust and prevents churn.

Personalize customer engagement

Generic email blasts won’t cut it. Customers expect tailored experiences based on their needs and behavior. Ways to personalize engagement include:

- Segmenting customers and creating targeted campaigns for each group

- Using customer data to recommend relevant features or tips

- Offering one-on-one training to help users get more value from your product

When customers feel seen and supported, they’re more likely to stick around.

Continuously gather customer feedback and act on it

The first step in improving retention is understanding what keeps customers coming back. Or, what drives them away. Regularly soliciting customer feedback allows you to pinpoint areas for improvement. Try using:

- a public feedback board

- surveys

- suggestion boxes

- interviews

- monitoring customer support channels

More importantly, acting on this feedback shows customers their opinions matter, fostering loyalty.

Invest in onboarding and customer education

Focus on building a well-structured onboarding process. It can make all the difference between a user who feels lost and one who quickly finds value in your product. Consider adding these to your onboarding process:

- Educational email sequences

- In-app product tutorials

- FAQs

- Help pages

- Product webinars

These not only help smooth out the learning curve but also empower users to get the most out of their purchase.

Reward loyalty with exclusive perks and discounts

There are a lot of ways to reward loyalty:

- Loyalty programs that offer tangible rewards

- VIP benefits

- Sneak peeks at new products

- Public recognition

All these encourage repeat business by making loyal customers feel valued. Remember: Improving retention rates requires ongoing effort across multiple fronts. Don’t just focus on initial customer contact points. Follow through with post-purchase support & beyond.

Continuously improve your product

A great product keeps customers engaged. The best companies never stop iterating based on customer feedback. Keep your product valuable by:

- Adding requested features that solve real customer problems

- Streamlining workflows to improve usability

- Pivoting strategies when necessary to stay competitive

Retention comes down to delivering ongoing value. The more customers see your product evolving to meet their needs, the more likely they are to stay.

The key is to always be thinking about how you can deliver more value to your customers. The more you can exceed their expectations, the more likely they are to stick around.

Retention rate and customer experience

Customer experience is everything. It’s the make-or-break factor that determines whether your customers stick around. Companies that prioritize customer satisfaction and listen to their needs are the ones that thrive.

Impact of customer experience on retention

Would you keep using a product that left you feeling frustrated, unheard, or unsatisfied?

Probably not.

But what about a company that provides exceptional service and values your feedback?

That creates loyalty that’s hard to break. In fact, a PwC study found that 73% of consumers say customer experience is a key factor in their purchasing decisions. Additionally, 43% are willing to pay more for greater convenience, and 42% would pay more for a friendly, welcoming experience.

Focusing on customer experience doesn’t just improve retention—it also boosts your bottom line.

Measuring customer satisfaction

How do you know if you’re hitting the mark on customer satisfaction? It all starts with listening. Regularly collect feedback through surveys, reviews, and one-on-one conversations. This helps you understand what’s working and where there’s room for improvement.

Several key metrics can help you track customer satisfaction:

- Net Promoter Score (NPS): Measures how likely customers are to recommend your product. A high NPS suggests strong loyalty, while a low score signals potential churn.

- Customer Satisfaction Score (CSAT):

- Gauges immediate satisfaction by asking customers to rate their experience. It’s often used after interactions like support chats or purchases.

- Customer Effort Score (CES):

- Measures how easy or difficult it is for customers to complete a task—like signing up, using a feature, or getting help. The lower the effort, the higher the satisfaction.

Each metric provides a different perspective on customer happiness. Tracking them together gives a well-rounded view of how satisfied and engaged your users are.

Want a deeper dive into these metrics? Check out this guide on customer satisfaction metrics.

Addressing customer pain points

Once you have a pulse on your customers’ needs and pain points, it’s time to take action. This might mean:

- investing in better training for your customer support team

- streamlining your onboarding process

- adding new features based on customer requests

.The key is to continuously iterate and improve based on the feedback you receive. Show your customers that you value their input and are committed to providing the best possible experience.

Retention rate vs. churn rate

Now, let’s talk about the flip side of retention rate – churn rate. Retention rate measures the percentage of customers who stick around. Churn rate looks at the percentage who leave.

Difference between retention rate and churn rate

It’s important to track both metrics to get a full picture of your business’s health. Retention rate tells you how many existing customers stayed. Churn rate shows how many left. Since they’re directly linked, if one is high, the other must be low.

For example, if your monthly retention rate is 90%, then your churn rate is 10%. This means that for every 100 existing customers at the start of the month, 90 stayed, and 10 left. Losing customers at that rate might not seem like a big deal, but over time, churn can add up and slow your growth. Even if you’re acquiring new users, consistently losing existing ones makes it harder to scale.

Existing users often spend more than new customers too. They’ve had more time to increase their usage, add users, or upgrade. Losing an existing customer often has a larger revenue impact than winning a new one.

Factors contributing to customer churn

So what causes customers to churn? There are many factors at play. These include poor customer service, product issues, pricing changes, and competition. In my experience, the most common reasons customers leave are:

- Lack of value or ROI

- Poor user experience

- Better alternatives in the market

- Changes in their own needs or budget

If you’re tracking why your customers leave, you can work to prevent future churn. Asking why they’re leaving when they cancel is a great first step. Consider asking your customer success team to reach out to find out why too. They might even prevent the customer from leaving.

Strategies for reducing churn rate

Reducing churn starts with a strong retention strategy. Some of the most effective tactics include:

- Improving onboarding and customer education – Help customers find value quickly with clear onboarding, tutorials, and support.

- Providing proactive customer support – Solve issues before they escalate by reaching out before customers consider leaving.

- Gathering and acting on customer feedback – Regularly ask for input and make meaningful changes based on what you hear.

- Offering incentives and loyalty programs – Reward long-term customers with exclusive perks, discounts, or special access.

- Continuously improving your product – Keep evolving based on customer needs to stay competitive and valuable.

Make retention a top priority, and you’ll reduce churn while building a loyal customer base that sticks with you.

Balancing customer acquisition and retention

Focusing on retention doesn’t mean you should stop acquiring new customers. The key is finding the right balance between acquisition and retention based on your business model and growth stage.

For early-stage startups, acquisition is the priority. You need to build a customer base. But as your company matures, retention becomes just as important. Keeping existing customers engaged and reducing churn fuels long-term growth.

A helpful way to evaluate this balance is the LTV:CAC ratio. It compares lifetime value (LTV) to customer acquisition cost (CAC). If your LTV:CAC ratio is too low, it may mean you’re overspending on acquisition without retaining customers long enough to justify the cost. A 3:1 ratio or higher is considered healthy. This means customers generate at least three times more revenue than it costs to acquire them. This ensures your growth is both sustainable and profitable.

Retention: the key to sustainable growth

Retention rate isn’t just a number. It’s a powerful tool for keeping customers happy and driving long-term success.

By understanding how to measure retention, what influences it, and how to improve it, you can build a loyal customer base that sticks with you.

Happy customers are the lifeblood of any thriving business. Keep a close eye on your retention numbers, listen to your customers, and focus on delivering value. The more you invest in creating great experiences, the stronger your business will be.

Your bottom line will thank you.