No one wants to hear that they’re losing revenue that should be flowing to their bottom line. Yet, this is quite often the case. Many businesses bounce back, but recouping the full revenue is still a concern.

Effective revenue recovery for SaaS means tracking more than declined payments. Use a strategic approach to identify subscription lapses and pricing optimization opportunities. This helps you maintain profitability and growth.

Do that, and you’ll recoup far more than you’ve lost. What’s more, you’ll uncover critical insights into customer behavior. These will inform your decision-making and fuel sustainable expansion.

But first, the basics—how exactly does recovery work?

Understanding revenue recovery

Revenue recovery is the process of tracking, preventing, and recovering lost revenue. To build that safety net, track everything from declined payments to potential churn and pricing issues.

In plain terms, this involves:

- Spotting those bothersome failed payments

- Winning back the hearts of defecting customers

- Improving pricing strategies to shore up revenue leaks

- Identifying opportunities to optimize your subscription lifecycle

The best part? While it’s a preventive measure, you’re not stuck playing defense. Adopting the right approach to revenue recovery helps you keep your hard-earned revenue. More importantly, it also provides opportunities (benefits) that help expand it.

The importance of recoverable revenue

Businesses are increasingly adopting subscription models. This poses different challenges than traditional one-time sales. You’ll deal with a barrage of micro-transactions after user activation. This cuts across different payment methods, time periods, and even pricing tiers.

This transformation in how businesses generate and collect revenue complicates the billing system. Multiple transaction points mean more potential opportunities for revenue leaks.

What’s more, small issues can snowball into serious concerns. Take an isolated failed payment, for instance, and multiply that by several hundred customers over several months. If that happens, revenue will dip.

Every dollar you lose could also go on to cost more than the value of the bill itself. Revenue leakage influences your growth metrics and customer lifetime value. It also affects your ability to scale.

How does that work?

Consider your focus when growing your SaaS business—perhaps it’s on acquiring new customers.

Now imagine customer churn results in the loss of over 10% of existing revenue due to avoidable issues that push customers away. You’ll need to add 10% more customers to break even. This is a big ask for any business, but especially so for a subscription one, as customer acquisition costs are often high for them.

On average, it costs 5 times as much to acquire a new customer as it does to keep an existing customer.

Getting a new customer to commit to a recurring payment also requires more effort and is more cost-incurring than a one-time purchase. The math paints an even clearer picture when we look at valuation. Valuation for SaaS companies is based on a multiple of their annual recurring revenue (ARR). So, a dollar of leaked revenue could cost you anywhere from five to ten more in company value.

What are the types of recoverable revenue?

It’s time to reveal the face behind the mask—what exactly are these revenue types that are playing hard to get?

Failed payments

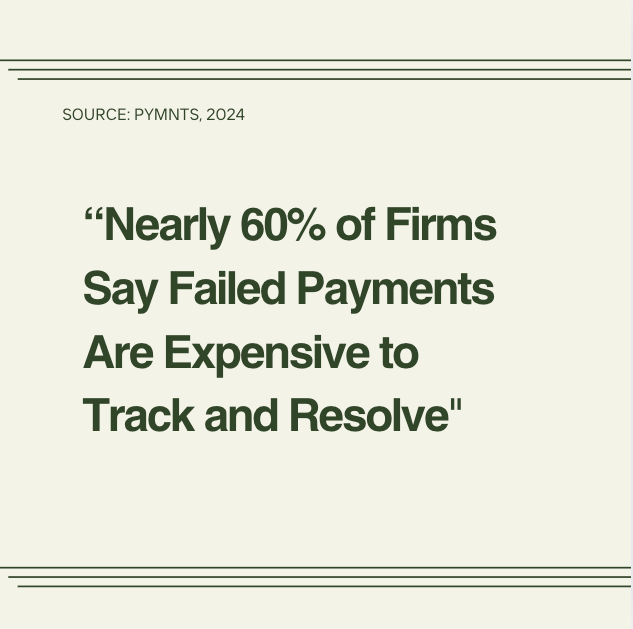

It might surprise you to know how many payments fail for simple reasons. And about 60% of businesses find these failed transactions costly to monitor and resolve.

Common causes for payment failure include:

- Expired credit cards

- Insufficient funds

- Outdated billing information

- Bank declines

- Processing errors

Delinquent Accounts

It’s not uncommon for model customers to drift off into delinquency. Sometimes, all it takes is missing a payment notification. Many of these customers won’t even know they’ve churned until they try to use your service and can’t access it.

Initiating a dunning sequence is the perfect recovery method to combat this. Depending on your brand voice, you can choose to make your messages subtle—more like a helpful reminder than a stern collection notice.

For example, “Hey, it seems your credit card is due a long vacation—mind updating it to retain access?”

One of the most common ways to start the dunning process is via email. Ideally, you’ll only have to send one. However, the reality is that sometimes, you will have to send a series of dunning emails before you’re able to get through to the customer.

Every dunning email should generally include the following:

- Your company name and product details

- The reason(s) for the email

- Payment details—how much the subscription payment is and for which period

- Payment link or call-to-action button to make the experience as easy as possible

- Payment schedule to let your customer know when to pay to avoid service interruption.

- Contact information of the support team so they can reach out should they have any concerns.

Here are some examples:

Renewals

The overlooked opportunity! Renewals are worth so much more than retaining customers. They’re prime opportunities to expand your revenue. Avoid treating them like straightforward yes-or-no checkboxes.

Proactive customer engagement is the key. Your renewal strategy should engage customers before their renewal dates come knocking. Focus your efforts on:

- Engaging at-risk accounts early

- Highlighting value delivery

- Identifying and recommending upgrade opportunities

- Addressing usage patterns

- Offering right-sized solutions

Here’s an example email:

Subject: Reminder: Your [Service Name] subscription is nearing renewal on [Date]

Dear [Customer Name],

This is a friendly reminder that your current subscription to [Service Name] is set to expire on [Date]. To ensure uninterrupted access to all the features you’ve been enjoying, please renew your subscription before then.

Here’s how to easily renew:

- Log into your account at [login link]

- Go to the “Subscription” section

- Click “Renew Now”

As a valued customer, we’re offering you a [discount value]% discount on your renewal when you choose an annual plan!

Use code: RENEW [Discount Code] at checkout.

If you have any questions or need assistance with the renewal process, please don’t hesitate to contact our support team at [Phone Number] or [Email Address].

Thank you for choosing [Service Name]!

Best regards,

The [Company Name] Team

Pricing misalignment

Yet another overlooked opportunity. Customers will sometimes outgrow their current plans but remain stuck there. Ah, the agonies of limbo—the potential revenue they could generate slipping away.

When their usage needs exceed plan allowances, you’re leaving money on the table if you don’t encourage them to upgrade. Plug into smart usage tracking and proactive outreach to recover this lost revenue.

Here’s an example email:

Subject: Unlock the full potential of [Service Name] with an upgrade!

Hi [Customer Name],

We’ve noticed you’re using [Service Name] and making great progress! To take your results to the next level, consider upgrading to our [Plan Name] plan and access powerful features like:

- [Feature 1]: [Brief explanation of how it benefits them]

- [Feature 2]: [Brief explanation of how it benefits them]

- [Feature 3]: [Brief explanation of how it benefits them]

See how much easier [specific task] can be with the [Plan Name] plan!

Click here to upgrade now and start experiencing the full power of [Product Name]:

[Call-to-action Button]

Best regards,

The [Service Name] Team

Feature adoption gaps

Customers who don’t use premium features might downgrade their plan or fall off entirely. Beat them to the punch—help them get value from all available features to stop revenue loss in its tracks. There are a few ways to do this:

- Use in-app guidance and messaging to highlight new features or guide users through commonly used ones and showcase how to get the most out of them.

- Send personalized in-app notifications or emails based on user behavior. These can promote features most relevant to them, as well as additional ones that could be useful based on their needs and how they use the service.

- Communicate new features through new feature announcements on various channels. These could include blog posts, social media, email campaigns, and product updates.

For example, a user logging into their account may encounter the following pop-up once they access their dashboard:

“A fresh New Look For Your Dashboard—Experience your dashboard in a fresh new look! We have completely restructured the dashboard interface to help your team get work done faster. Let us know what you think!”

Usage-based fluctuations

Usage-based pricing models charge customers based on their utilization of a product or service within a set billing cycle. This can be monthly, quarterly, or annually.

These models are often used in everyday transactions—think of paying for an Uber ride or an electricity bill; you pay only for what you have used.

There is a shift occurring towards usage-based pricing within the Saas industry. Big companies like AWS, Snowflake, and Twilio are adopting it. AWS, for instance, offers its customers a pay-as-you go payment approach for most of its cloud services.

A usage-based pricing model for SaaS businesses brings many advantages for both consumers and the business. These include better pricing flexibility and lower barriers to entry for customers. Moreover, it improves customer loyalty.

If you use this model, ensure that you track usage closely at the right intervals so you don’t skip peak usage periods where you can demand premium prices.

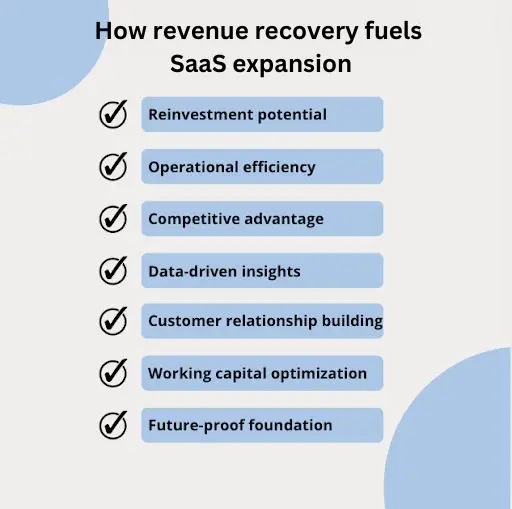

How revenue recovery fuels SaaS expansion

Finding extra cash in an old coat pocket is amazing, but discovering untapped revenue streams in your SaaS business is even better. Let’s discuss how smart SaaS companies are making their pockets that much deeper with recovered revenue.

Reinvestment potential

Every dollar you recover is a dollar you can pump straight into growth. The great thing is that recovered revenue is efficient to reinvest as it doesn’t come with the acquisition costs of new revenue.

Your newly discovered goldmine could allow you to:

- Fund customer success initiatives

- Develop that must-have feature users are requesting

- Launch your enterprise sales team

- Take marketing campaigns from the drawing board to the real world

- Enter new markets while sustaining healthy unit economics

- And many other initiatives

Operational efficiency

Effective recovery processes save you money, yes, but they also make for smoother customer experiences. Streamline payment handling and account management. This will give your team ample time to prioritize growth instead of firefighting failed payments. It also doesn’t hurt that efficient payment systems keep customers happy and loyal.

Competitive advantage

Focus on maximizing customer value. Your revenue recovery efforts can help give you a competitive edge. Predictable growth, reduced acquisition costs, and higher customer lifetime value are valuable advantages.

Data-driven insights

Your recovery program is a vault filled with rich insights. For instance, payment patterns expose expansion opportunities. Usage data spotlights upsell timing. Recovery rates reveal optimal pricing tiers. You couldn’t see things clearer if you had a crystal ball.

Customer relationship building

Revenue recovery, done right, also builds meaningful customer relationships. Spot a failed payment early or optimize the value proposition for customers who have outgrown their current plans. Whatever the case, you’ll be creating memorable experiences that trigger expansion conversations. It’s a great incentive for customers to upgrade or expand their usage.

Working capital optimization

The better your recovery rates, the more predictable your cash flow. This allows you to take on bold growth initiatives without nervous nail-biting. You’ll have a bigger safety net to fall back on if things don’t work out.

Future-proof foundation

The humble recovery systems you invest in today will grow exponentially as your business scales. Maybe improving your recovery rates by 2% at your current size only translates to a $10k monthly return. But imagine what that number will look like when your SaaS business is five times bigger than it is now.

Strategies for effective revenue recovery

Here are some best practices to guide you on your journey to revenue recovery.

Be proactive

It can be tempting to take a reactive rather than a proactive approach to revenue recovery. However, being proactive can save you a lot of headache in the long run, and is a more effective strategy to adopt.

A forward-thinking approach allows you to predict potential pitfalls. You’ll also be able to design strategies to prevent them. Make use of predictive analytics, trend tracking, and customer behavior analysis. These will help you to identify and successfully mitigate potential risks before they affect your revenue.

Formulate a strategy based on a set of warning signs—low engagement, users not using key features, and negative feedback. Once you have your criteria, keep an eye on your users and take action before they end up leaving. Technology can be helpful when it comes to tracking user engagement and behaviour—more on this later.

Renewals

Renewals are one of the best ways to grow revenue for your SaaS business. To make the most of this opportunity, reach out to key accounts ahead of renewal time to set them up for success.

We’ve seen how to do this via email. Depending on how your business is set up, you can also reach out to them via phone, or in certain cases, hold a face-to-face meeting.

Make sure the user is happy with the service, address any concerns they may have, and help them adjust their subscription if needed. Doing this will go a long way to handling potential obstacles to renewal and satisfying your customer. This will encourage them to renew their subscription.

Follow up

Keep a finger on your business’ pulse and monitor when billing contacts change or leave the account so you can follow up. Stay informed about key changes within your customer accounts. This allows you to gather valuable insights and take appropriate action.

When billing contacts change, it’s an opportunity for you to step in and ensure that payments continue uninterrupted. Follow up with the account users to ensure that all billing details are updated and payments continue as expected. Figure out who the new billing contact is. This reduces the risk of churn and increases the likelihood of revenue continuity.

Following up also opens up a chance for you to build a stronger relationship with the existing customer. You can ensure the financial aspects are smooth and use this opportunity to check in on the customer’s satisfaction with your service. You can also explore potential upsell or cross-sell opportunities.

If the customer is looking to leave, it’s a good idea to hold an exit survey to determine why they left and if this is something you can avoid in the future.

Pay attention to customer feedback

Customers often tell you exactly where the money is—all you have to do is listen. The qualitative insights you get directly from the horse’s mouth are what matter most. Customer support tickets on feature limitations or billing issues show you where you can improve. Add feedback loops wherever you can. Ensure customers can always share their thoughts, regardless of where they are in the customer journey.

Always revisit past customer support queries and chats to find issues that need resolution. Take prompt action to improve what needs improvement and keep your revenue where it belongs—in your pockets.

The following channels will help you maximize the value of customer feedback:

- Exit surveys after subscription cancellations

- Instant response forms after a payment fails

- Monthly check-ups with high-value accounts

- Chat support, customer success called, and feedback shared on your Canny board

Using a Canny board to consolidate your feedback and surface its revenue impact is a huge help here.

Conduct revenue audits

Regular revenue audits are a soothing tonic for your accounting team. These audits are a treasure map; “X” marks the spots where your revenue is going down the drain. Modern analytics tools such as Chargebee use key metrics that are important for your recovery efforts.

These KPIs include:

- Common causes of payment failures by category

- Average recovery time

- Recovery rate by customer segment

- Churn risk indicators

- Revenue leakage points

Conduct weekly audits to track these numbers. Identify patterns and develop comprehensive action plans for each issue.

Leverage automation & technology

No one wants to run around chasing failed payments. The good news is that smart automation can handle the heavy lifting. Use this automation checklist as a guide:

- Use smart payment retry logic

- Leverage targeted dunning email sequences

- Set up automatic card updater services

- Install failed payment notification systems

- Configure triggers for usage-based upgrades

Technology is generally a great tool to exploit when it comes to revenue recovery and expansion across your business. There are many options that offer very helpful features.

CRM systems

CRM platforms like Salesforce or HubSpot help businesses track customer interactions. They can also be used to manage leads and streamline sales pipelines. Use them to identify at-risk customers by analyzing user patterns and engagement.

You can then segment customers effectively to offer personalized pricing. Segmenting can also help you formulate solutions to reduce churn.

In addition, you can keep track of renewal dates to ensure that you reach out to your customers beforehand.

Billing Software

Tools like Stripe, and Recurly can manage subscriptions, invoicing, and payment collection. Use this to automate recurring billing so invoices are accurate and sent on time. It also helps you implement the dunning process for overdue payments.

Critically, these software provide businesses with better visibility into revenue and payment issues. With this, you can improve cash flow management and strengthen the revenue recovery process.

Subscription Management Platforms

Comprehensive solutions like Chargebee or Paddle manage customer subscriptions, renewals, and plan upgrades. They generally also include features that allow you to handle billing. Among countless great features, these provide easy ways for your customers to upgrade or downgrade their plans. In this way, you decrease churn rates by offering flexible options.

Many seamlessly integrate with key systems such as CRM and accounting software. This added bonus promotes a smooth flow of information across different platforms. This reduces manual data entry and minimizes errors.

This technology can prove invaluable in establishing a strong revenue recovery process.

There are also other areas in which technology could help you. For instance, you may find the perfect billing software suited to your business needs. However, if your staff isn’t trained or tech-savvy, this development may lead to setbacks. You may oversee each and every hire or use call center outsourcing to handle client communications. Regardless, your workforce needs to be up to the task.

RPO technology (recruitment process outsourcing) like Oleeo helps you streamline your screening and assessment process. This significantly enhances your recruitment process. As we’ve seen, customer retention is an important element in revenue recovery. RPO technology can help you build a strong and agile team that can adapt to the technology you choose to implement. You can easily prioritize building a team able to swiftly address customer issues.

Debt collection

For a subscription-based SaaS business, recurring payments are the primary revenue stream. Delayed or missed payments can severely impact cash flow.

Debt collection ensures that this flow remains steady. It lets you recover overdue payments and reduces the risk of non-payment. A solid debt collection strategy helps your business to protect its bottom line. It helps recover as much outstanding revenue as possible and preserves the profit margins that fuel growth.

Despite the connotations, debt collection doesn’t have to be a confrontational process. There are strategies that you can use to recover lost revenue while maintaining customer goodwill. Before resorting to debt collection, make sure that you have extensively explored other options. Give your customer as much time and flexibility when it comes to settling their balance.

- Automated payment reminders: Set up automated reminders to be sent when payments are overdue. This will often prompt customers to act before the situation escalates.

- Payment plans and negotiations: Offer customers a structured payment plan. Also, negotiate terms for overdue payments. This will likely ease financial strain on the customer. This in turn will increase the likelihood of recovering the debt while preserving the relationship.

- Escalation to Collections: In more severe cases, customers may fail to respond or repeatedly default. You may need to escalate the situation to a third-party collections agency. This can be a last resort but in some cases, it can be necessary to recover significant debts and protect your business.

Continuous monitoring—because money doesn’t sleep

Successful recovery programs evolve with the business. Your recovery system is not one-and-done. You must test new technology and methods, review results, and make adjustments where necessary. What worked yesterday might be a bottleneck today.

Don’t ignore the legal side

Revenue recovery fuels expansion for SaaS businesses. It blocks revenue leaks and reveals growth opportunities. But you do still need to stay on the right side of payment regulations. It’s a delicate balance between effectiveness and compliance.

You want to start with your payment terms and conditions. They must define your processes for dealing with failed payments, delinquent accounts, and dunning. That’s how you avoid misunderstandings with customers.

Take compliance a step further by engaging legal experts who understand the needs of a subscription business. They can help you structure your recovery process around local and international regulations.

Turning lost revenue into your next big win

Revenue recovery is a crucial element of sustaining and growing your SaaS business.

It helps you track, prevent, and recover lost revenue. With it, you can turn potential financial losses into opportunities for expansion.

Be proactive, leverage technology, conduct regular audits, and stay close to your customers. This will allow you to stay on top of subscription lapses and exploit pricing optimization opportunities. Consider debt collection when necessary. And of course, don’t forget to continuously ensure you are adhering to applicable regulations.

Establishing a strong revenue recovery process will give you a competitive advantage. It improves cash flow predictability and can drive customer loyalty, setting you up for long-term success.