SaaS pricing can be tricky. We launched Canny almost a year ago. During that time, we reached ramen profitability. We also changed our pricing four times.

As a bootstrapped startup, we needed to monetize from the start. Not to mention, paying customers is a great signal for product-market fit. We knew pricing would be essential to get right.

But this isn’t a story about how we doubled our pricing and became an overnight success. In this post, I’ll go over each attempt, our mistakes, and what we learned.

Embrace the unknown

When you first start out, SaaS pricing is more of an art than a science. You don’t have enough customers to run A/B tests, every attempt goes out to 100%.

That’s why it was crucial for us to talk to our initial customers during these experiments. We kept a pulse on their sentiment instead of making decisions on data.

- Are people willing to pay for what we offer?

- Are people confused about our pricing?

- What makes people hesitant to buy?

Attempt #1 (March 2017 – April 2017)

What we did

Decided on prices

A tad better than pulling numbers out of a hat: we chose numbers based on competitor pricing and our gut.

Priced based on a value metric

For Canny, a feedback management tool, we landed on total number of users. Our thinking was: the bigger the user base, the more feedback they’d get, and the more they should pay.

Included a $2 plan

We opted for a cheap plan instead of a free plan. The idea was to avoid high support costs and weed out people who weren’t serious about using Canny.

Problems

Unmeasurable metric

There was no way for us to know the total number of users of a product. People who realized this signed up for the lowest plan.

Confusing value metric

People didn’t understand what we considered a “user”.

Lack of focus

This was our biggest problem. We made the mistake of trying to target B2B, B2C, and consumer companies. The use cases were drastically different so pricing was completely misaligned.

How we felt

Our launch went quite well. It seemed like people resonated with what we were building. Still, there was a lot of confusion around pricing.

On the other hand, we got messages about increasing our prices.

As we got more input, we were able to identify patterns that started shaping our target audiences.

The $2/mo plan was a bust. We expected way more people to opt-in. We ended up wasting time chasing people for what ended up being only $24/year.

Lesson

The more you narrow down your target audience, the better you can position your plans. When someone looks at your pricing page, they should understand which plan, if any, is for them.

You can always expand your audience after you have a better understanding of the market.

Attempt #2 (May 2017 – July 2017)

We talked to many potential customers in attempt #1. That’s how we were able to hone in on our ideal customer and their use case.

What we did

Chopped the $2 plan and added a custom plan

The $2 plan made us look cheap. The custom plan adds flexibility and anchors us higher.

Lowered our user limits

We learned in attempt #1 that Canny was less valuable for consumer companies. So we cut them out.

Added new limits

We thought more limits would encourage people to upgrade.

Problems

Unmeasurable metric

We were still charging based on total users without being able to know how many users they have.

Ineffective plan names

Your plan names should guide the customer into the right bucket. These names didn’t mean anything to our target customer.

Complexity

We intended for the extra limits to push people into higher plans. They ended up pushing people away altogether.

How we felt

The lower user limits worked! While the plans were more complex, we started seeing more B2B and B2C companies sign up and convert.

That said, over 70% of teams signed up for the lowest plan because of our confusing “end user” limit. We knew we still had to nail the right value metric.

Learning

Keep things simple. From the features available to the design of your pricing page. Customers shouldn’t need to spend time calculating what they might need. Avoid putting them in an analytical mindset.

Intermission: The Survey

A few months after launch, we reached 50 paying customers. After reading countless blog posts about SaaS pricing, we tried to use data to inform attempt #3.

What we did

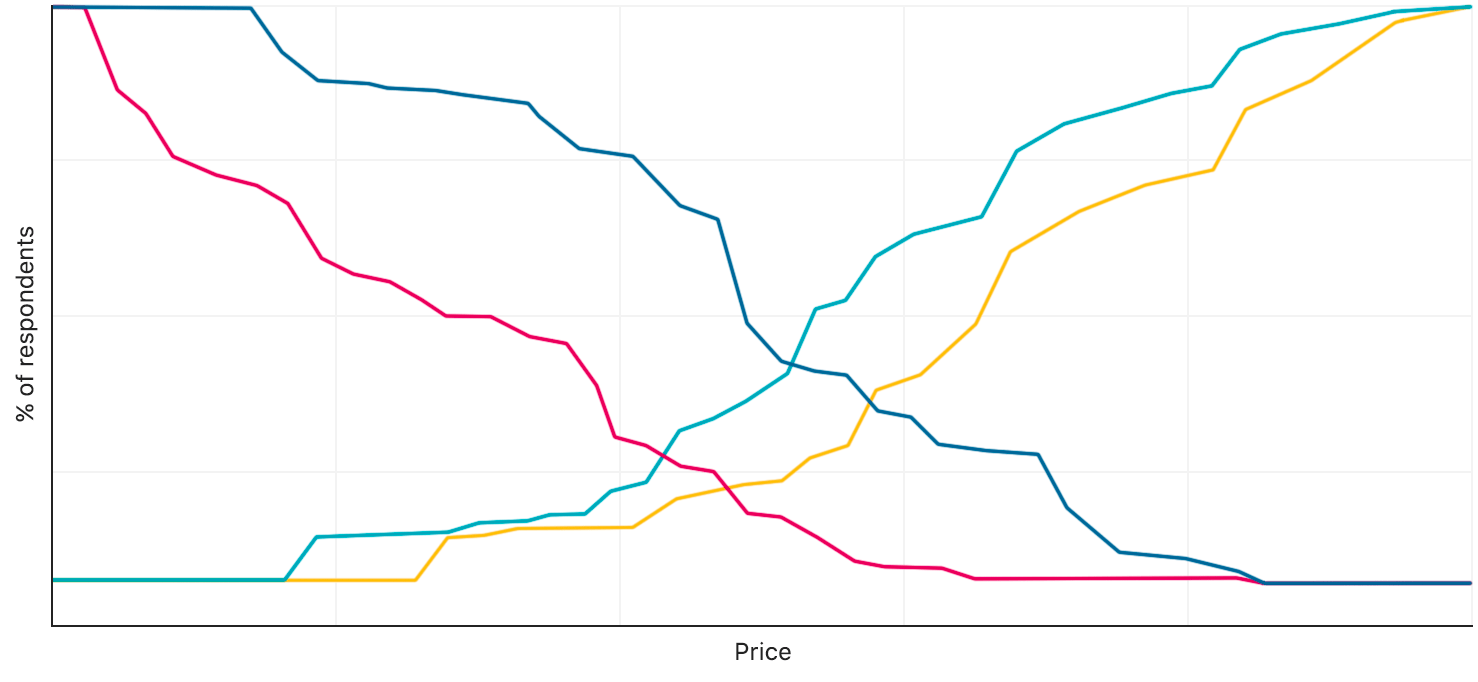

Ran a survey using the Van Westendorp method

If you’re not familiar, this survey consists of four questions:

- At what price would you think Canny to be so expensive that you would not consider buying it? (Too expensive)

- At what price would you think Canny to be so cheap that you would question the quality? (Too cheap)

- At what price would you think Canny is starting to get expensive, but you would still consider it? (Expensive/High Side)

- At what price would you think Canny to be a bargain—a great buy for the money? (Cheap/Good Value)

Analyzed the results (21 responses)

Which ideally looks something like:

But here was ours:

Problems

Too few data points

There was too much randomness, making our results unreliable.

Irrelevant sources = irrelevant data

Half the data points were from people not in our target audience.

How we felt

While the responses were interesting, the survey itself was a waste of time.

Learning

We can see how a survey like this would be helpful further down the line. Back when we ran it, we couldn’t collect enough relevant data points for this to be conclusive. You’ll learn more by actually changing your pricing and talking to users at this stage.

Attempt #3 (August 2017)

What we did

Cut down to a single plan

We eliminated confusion about which plan to choose.

Large price increase

We wanted to stress test willingness to pay.

Cut down to a single measurable metric

No more complexity with several different limits.

Introduced scaling pricing

We liked the idea of starting somewhere and growing with usage.

Problems

Anxiety

Our scaling metric is hard to predict, causing anxiety for potential customers.

High starting price cut growth

We cut out early-stage customers who couldn’t afford this price point.

How we felt

We didn’t have to look at Google Analytics to know that signups plummeted. Definitely due to higher prices and anxiety over scaling prices.

But the companies that did sign up were bigger and more qualified. There were teams willing to pay the price and scale with usage! This attempt confirmed that we made the right decision by going after B2B and B2C companies.

Learning

In hindsight, this was an overdramatic and impatient change. But it worked out. Don’t be afraid to make drastic changes. Attempt #2 was too timid and gave us lukewarm feelings around success.

While you’re making big changes, take care of your existing customers. If you’re raising prices, grandfather them to their current plan. If you’re lowering prices, give them some alternative options.

Attempt #4 (September 2017 – Present)

With three attempts under our belt, we felt confident going into attempt #4.

What we did

Brought back multiple plans

We created plans for each of our further developed buyer personas.

Tweaked numbers for a more generous scaling metric

We reduced anxiety by scaling slower and showing a slider.

Hid features under a toggle

To keep things clean, we only show the feature breakdown when you need it.

Problems

Anxiety

We stuck with scaling pricing even though it’s unpredictable. We know if we can pull it off, it’ll be a great way to offset churn.

How we felt

If we were pushing a boulder up a hill, this felt like the peak.

- We nailed our buyer personas and created plans for each.

- We defeated complexity with a single measurable metric.

- We lowered our starting pricing but kept scaling with usage.

Qualified conversions were coming in and people were rarely messaging about pricing confusion.

The best part: to this day, none of them have churned.

Learning

Your pricing will never be perfect. We’ve learned to see the tradeoffs and optimize for what’s important to our business.

For us, attempt #4 attracts customers we want and supports the revenue we need to push forward.

Why attempt #4 rocks

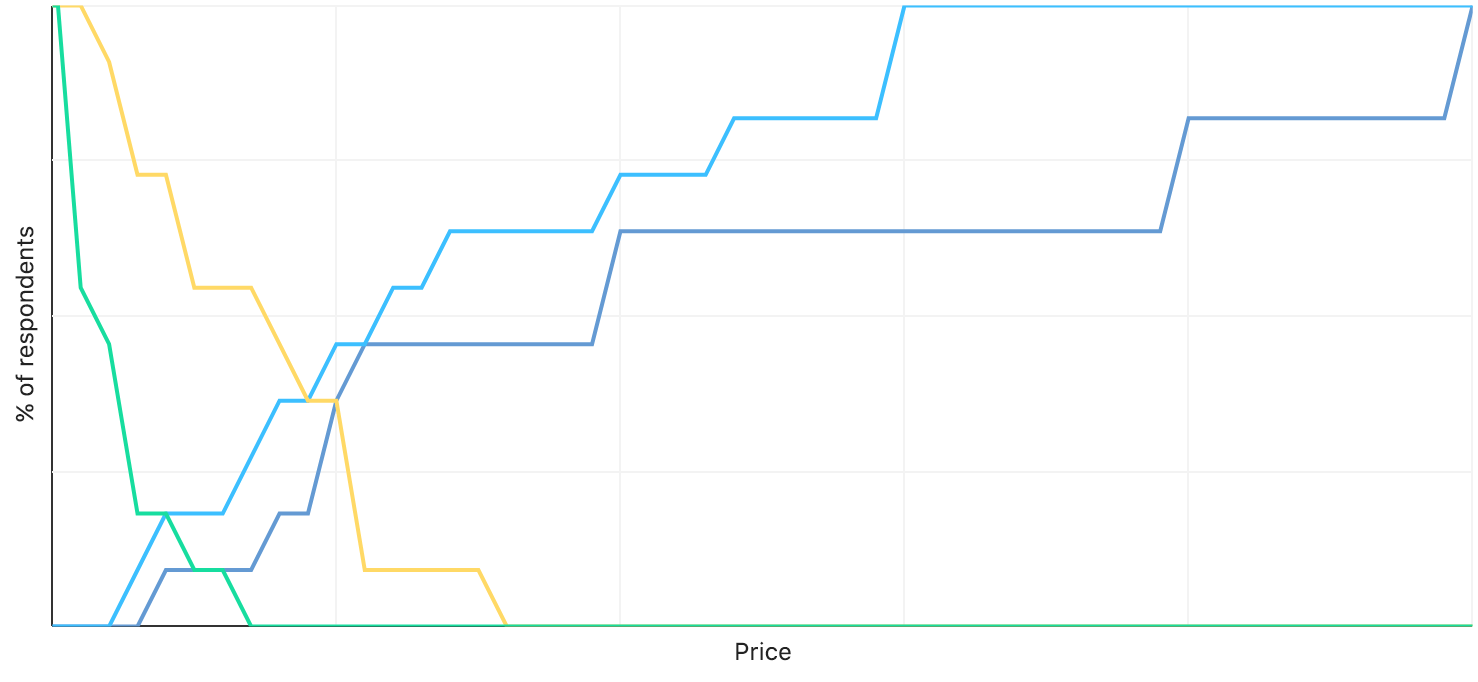

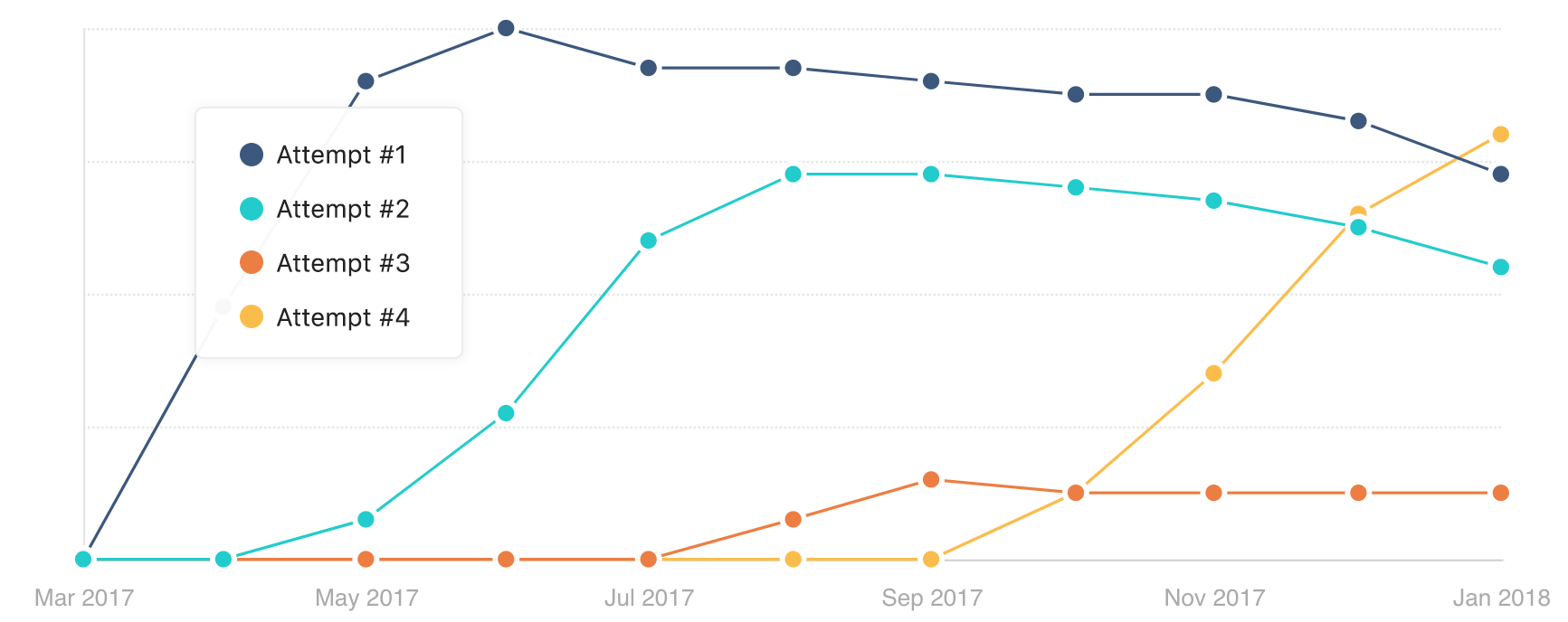

It definitely felt like we were making strides with each attempt but let’s see what the numbers say. Charts courtesy of our friends at ChartMogul.

Customers

More expensive plans acquire fewer customers. Makes sense.

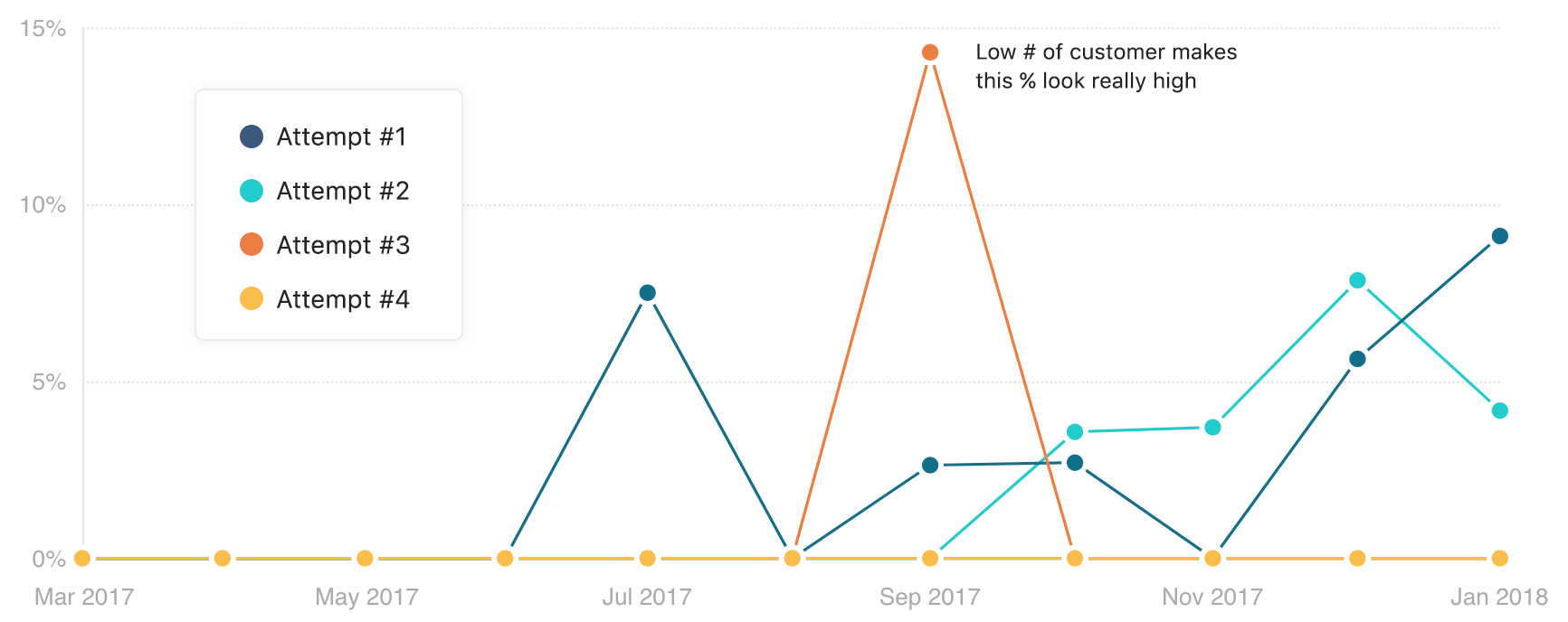

Average Revenue Per Customer (ARPC)

What’s more exciting, is our ARPC. While we acquire fewer customers, they pay 4-5x more per month than when we launched. Our pricing changes had a direct impact on this.

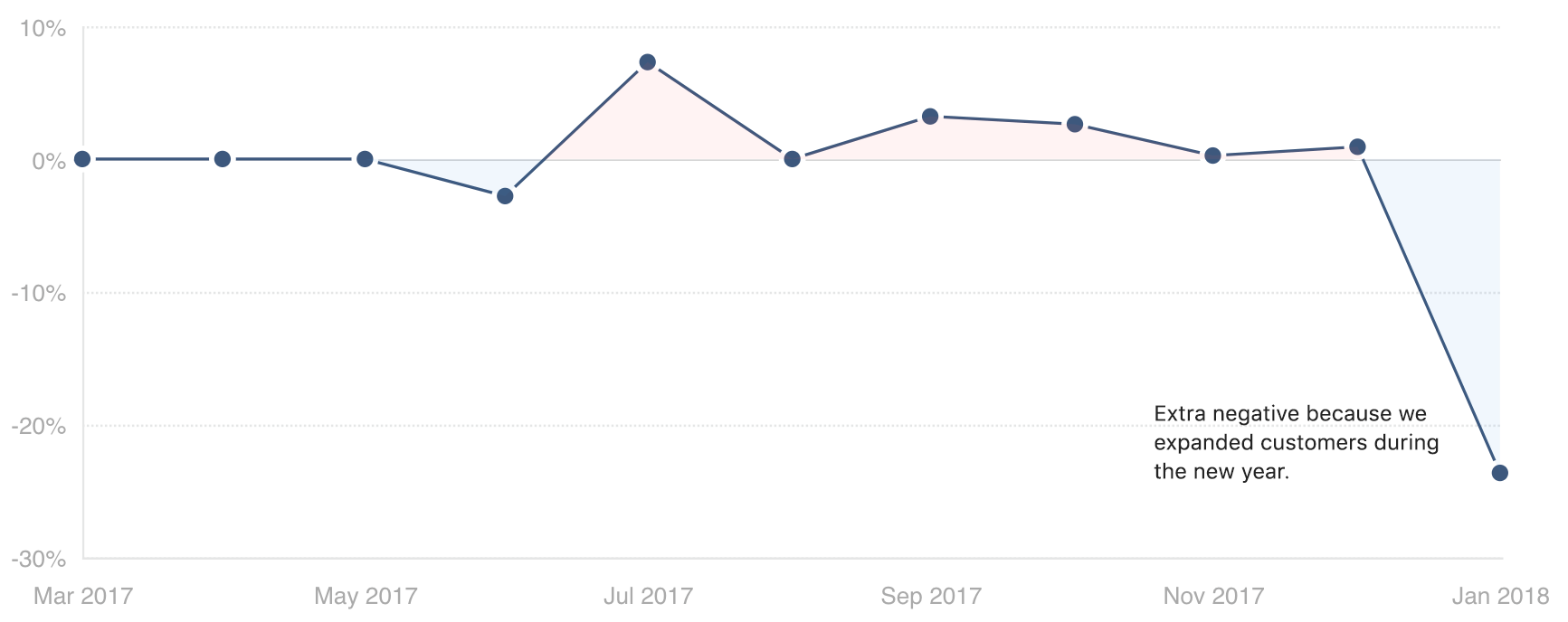

Churn

Churn is a very important number to keep an eye on. Here’s what it looks like when we split our churn by pricing attempt:

Churn from our first two attempts is much higher. The reason: those plans attracted more startups. As a result, several customers churned because their startup was shutting down. Recently, we’ve seen bigger, more established, companies sign up. In several cases, they end up scaling and offsetting our churn:

High ARPC and low churn mean high customer lifetime value (CLTV)! As we continue building Canny, keeping an eye on our CLTV will be important for optimizing our spend.

Attempt #5?

We’ve been with attempt #4 for over four months now but we know this isn’t the end. As we increase value via new features, we want to increase our pricing as well. We want to reinforce that Canny is a premium product. So much of pricing is psychological.

These are some experiments we’re considering:

Free plan

Last year, we went to this talk by Nick at ChartMogul on why they went freemium. Depending on your strategy, going freemium might be a great way to grow. For a public-facing product like ours, more customers would boost word-of-mouth growth.

Startup plan

When we started Canny, we wanted to be able to support teams of all sizes. Providing a generous startup plan would allow us to serve young companies.

We’re already testing this out by offering it as a custom plan. If you’re an early-stage startup that would like to use Canny, reach out to learn more about our special pricing.

Better trial

We started with a 30-day trial then we shortened it to 14 days. We aren’t happy with either. Instead of a time-based trial, new customers should be able to onboard at their own pace. Only pay once you start seeing value.

There is no such thing as beginner’s luck

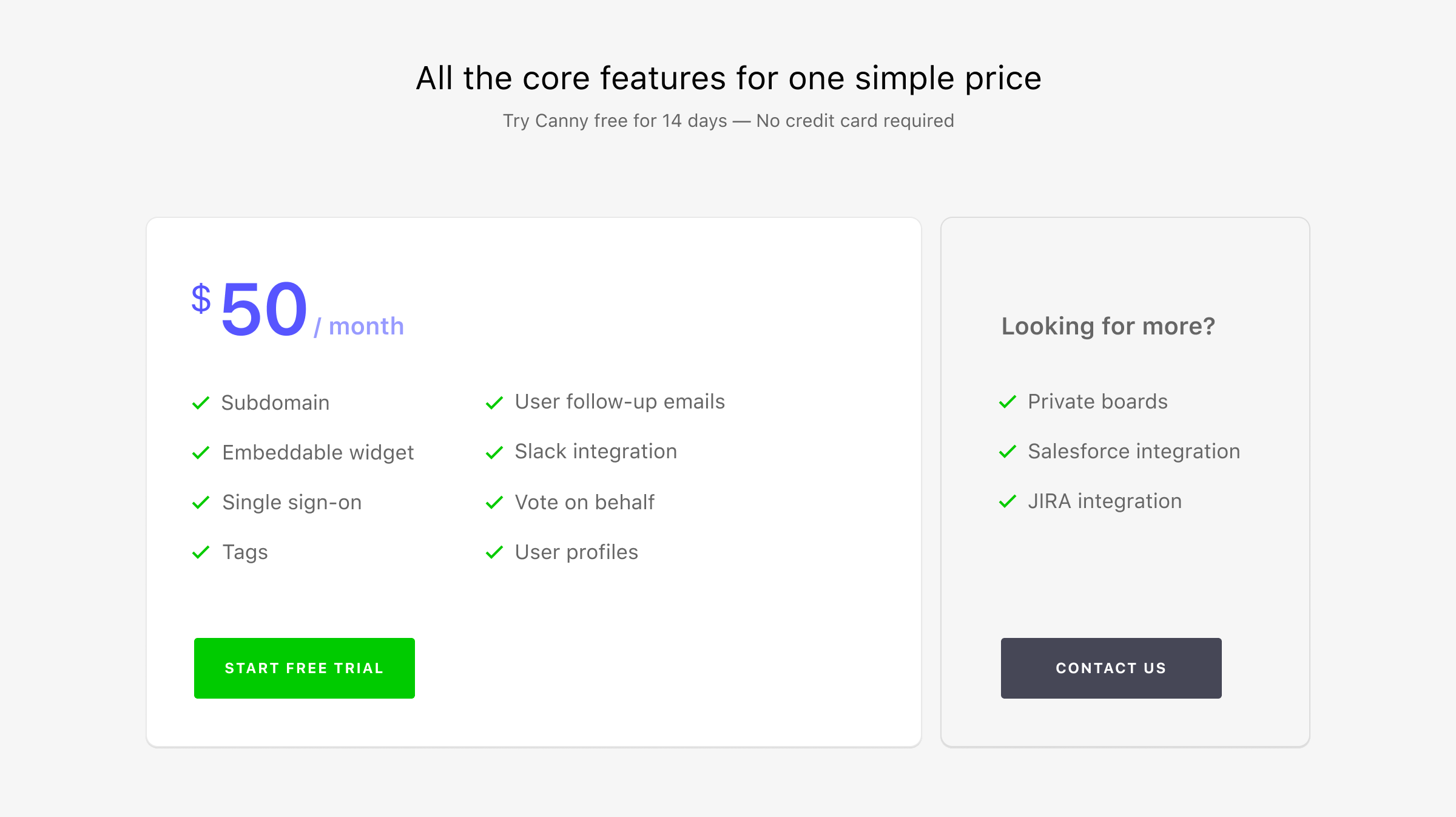

If we started this whole process again, we’d start with a single $50/mo plan. It’s straightforward, giving no reason for confusion.

Identify your target customer by talking to people and listening to objections, From there, price with them in mind, focusing on clarity and simplicity.

Once you have a good foundation, experiment! For us, scaling on a value metric is working well. Our customers who get the most value pay the most each month. For you, per-seat pricing could make more sense.

Pricing something you’ve put your heart into creating is tough and often emotional. Accept that your first attempt won’t be your pricing for long. Optimize to learn. If you’re in a similar boat right now, we hope this helps. Thanks for reading!

Smart Pricing is essential to the survival and success of your startup! Here are few more ideas to refine your pricing strategy: – Be very clear about who is, and isn’t, your target customer. Use tools like ‘Jobs to Be Done’ to better identify your target customers and understand what they really value. – Quantify the cost of the target customer’s problem, and the value of your solution. Most customers are pretty clueless about this; you must be an expert. – Be clear about your ‘position’ in the market relative to competitors: premium, low-cost, etc. Use your price to signal… Read more »

You have a great story. One more thing to remember, when you change pricing the way you done, you confuse many of your potential customers. And confused customers don’t buy. Thus, the journey you been on has been very costly for you in terms of lost sales. Therefore, it is crucial for any startup company to have pricing right from start.

I really appreciate you sharing such a complete story and results. thanks

Hi Sarah.

I was wondering, what made you guys choose a “trial” period over a 30 / 60 days money-back guarantee?

Cheers!

This is complete bollocks – pricing isn’t a finger in the air process – you have to ensure your selling price covers all your costs. When you know these figures then and only then can you start looking at a selling price on a cost plus basis. You might well find then that the scheme is unviable because your production costs are too high.

Interesting article! Noticed you sing. I might invite you to some interesting Discord events if you use that app. 🙂

Awesome read! Gives a lot of insights into defining the right pricing, and also that it’s ok to change pricing on a short period of time depending on your situation. Our company have changed price in January after a long period with an old price. We’re still evaluating our wins on that, and might have another conversation on updating price again…

While your approach is interesting and instructive, as a potential user of your product (note: I’m with a startup), it makes me apprehensive on three counts. 1. Pricing based on end-users is unfortunate, as it puts at odds two important goals: saving money and getting feedback. 2. From a technical perspective, I can see that it’s an arbitrary choice, as it doesn’t actually cost Canny servers more to provide for 1,000 users with 1 item of feedback than 1 user with 1,000 items of feedback. Knowing this makes me feel like its a money grab, and not directly tied to… Read more »