Have you ever been unable to stop a project simply because you’ve already invested so much? That’s a sunk cost.

What is a “sunk cost”? This term might sound technical, but it profoundly impacts our daily decisions.

A sunk cost is any past expense you can’t recover, no matter the outcome of ongoing efforts. It doesn’t matter if it’s money, time, or energy. Once spent, these costs shouldn’t influence future decisions. However, they often do, leading us into what’s known as the “sunk cost fallacy.”

Understanding sunk costs is crucial not only in business but also in our personal lives. It helps us make more rational decisions. When you recognize that sunk costs influence you, you can avoid wasting further efforts on lost causes.

Let’s explore the nature of sunk costs, their psychological impacts, and how we can avoid the common traps around them.

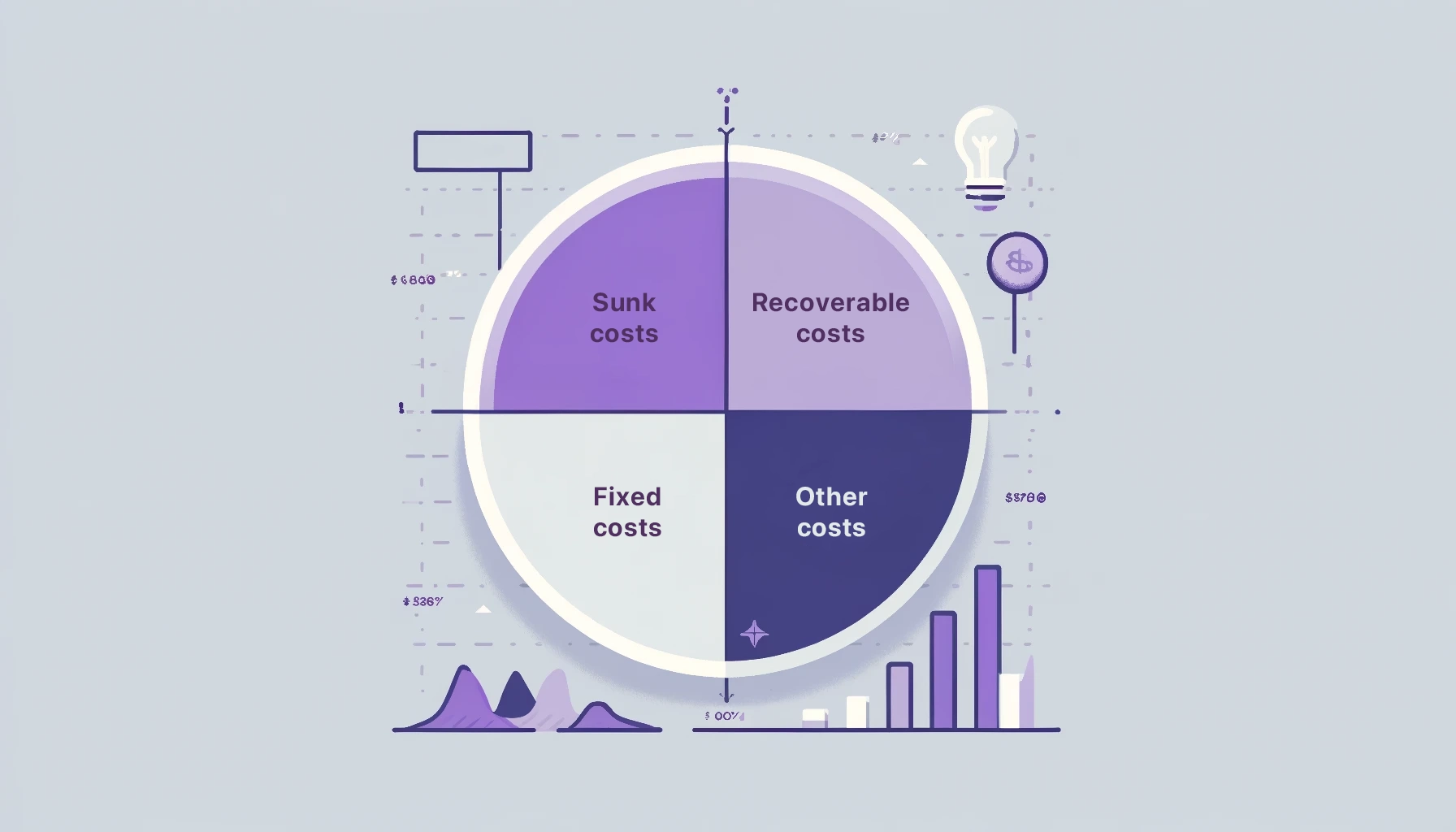

Sunk costs vs fixed costs

It’s easy to confuse sunk costs with fixed costs, but they’re different.

Fixed costs are expenses that do not change regardless of how much a business produces. Think of like rent or salaries. These costs are predictable and often unavoidable.

Sunk costs are funds you already spent and can’t recover, no matter what future outcomes.

For example, let’s say a company invests in a new software system that turns out to be inadequate. The money they spend on this system is a sunk cost. You can’t sell the software later to recover the money.

In contrast, they can sell or repurpose something like machinery (a fixed cost). There’s still some return on investment there.

Recognizing the difference helps make better decisions about where to allocate resources. You can focus on costs you can still influence rather than ones that have already been lost.

If you focus too much on sunk costs, you may fall into the sunk cost fallacy.

Sunk cost fallacy

The sunk cost fallacy is a common trap. It makes us continue a project simply because we’ve already invested resources, not because it promises future value. This can mean watching a bad movie until the end because you paid for the ticket. Or continuing a failing project because of the time and money already spent.

The fallacy lies in our emotional investment in what we’ve already “sunk” into the project. This clouds our judgment regarding future benefits and costs.

Economists argue that only future costs and benefits should influence our choices. The past costs are gone, and you can’t bring them back, no matter how you proceed.

This flawed mindset can lead businesses and individuals to make poor decisions that amplify their losses. A better strategy is to reallocate resources to more promising areas.

The psychology behind sunk costs

Our psychology deeply influences our decisions around sunk costs. Even when we logically know better, emotional factors can make it hard to let go of investments. Here are key psychological factors that lead to the sunk cost fallacy.

- Emotional impact and behavioral influence. Committing time, money, or effort to a project makes us emotionally attached. This attachment can cloud our judgment. It makes it difficult to abandon the project even when it’s clear that continuing is not beneficial.

- Loss aversion. This is our natural tendency to prefer avoiding losses to acquiring equivalent gains. This can lead to an irrational decision to continue investments to avoid feeling a sense of loss.

- Framing effect. How a decision is presented affects our choices. If quitting an endeavor is framed as a loss, we’re more likely to continue, even against our better judgment.

- Optimism bias. Often, we believe our projects will succeed despite evidence to the contrary. This bias can lead us to continue investing in a losing endeavor, hoping things will turn around.

- Desire to avoid waste. Stopping a project can feel like admitting this past investment was a waste. This feeling can be so uncomfortable that we continue investing, hoping to validate our initial investment decision.

Understanding these psychological triggers can help us recognize when falling into the sunk cost trap. Then, we can make more rational decisions.

Examples of sunk costs

Sunk costs are everywhere – from massive government projects to personal investments. Here are some good examples.

Concorde project

The British and French governments continued funding the costly Concorde supersonic jet despite overwhelming evidence that it was no longer economically viable. This financial decision is a classic example of the sunk cost fallacy. People often refer to it as a Concorde fallacy.

Business investments: Nokia

Companies often continue with projects even after clear signs of their ineffectiveness. Extensive marketing campaigns or new product development under a failing brand are often the evidence. Abandoning the project would mean acknowledging that all the money already spent was for nothing.

Nokia’s continued investment in its Symbian operating system is a good sunk cost example. Rival platforms like Apple’s iOS and Google’s Android saw rapid growth and increasing popularity. Still, Nokia continued to pour resources into Symbian. The company had already invested heavily in developing and establishing the platform in the market. Abandoning Symbian would have meant acknowledging that those investments were now irrecoverable. Nokia decided to stick with a lagging technology due to past investments. This ultimately hindered Nokia’s competitiveness in the smartphone market.

By the time Nokia shifted focus to more competitive operating systems, it had lost a much-valuable market share. This showcases the detrimental impact of the sunk cost fallacy.

Personal relationships, education, and careers

The sunk cost fallacy can affect us personally too. People might stay in unsatisfying relationships because of this. Or they continue pursuing degrees that no longer interest them. That’s because they’ve already invested much time and emotional energy.

Similarly, individuals might stick with unsatisfying jobs due to the training they’ve undergone.

These examples show how widespread and varied the impact of sunk costs can be across different areas of life and decision-making.

How to overcome the sunk cost fallacy

To avoid the pitfalls of the sunk cost fallacy, consider these strategies:

- Reevaluate objectives. Regularly assess whether your current endeavors align with your overall goals. This helps ensure you’re not just continuing something out of habit or sunk costs.

- Consider the opportunity cost. Consider what else you could achieve with the resources you dedicate to a faltering project. Alternative uses of these resources often offer better returns.

- Embrace flexibility. Be flexible and open to change. It can help you avoid unsuccessful ventures more easily and minimize further losses.

- Separate emotions from investment decisions. Try to make decisions based on rational analysis rather than emotional attachments to past investments.

- Seek external advice. Sometimes, an outside perspective can help you see the reality of a situation more clearly. External advisors or mentors can provide objective insights that aren’t clouded by the emotional investments you’ve made.

Conclusion: sunk costs, sunk cost fallacy, and more

Understanding the sunk cost effect is crucial for effective decision-making. As we’ve explored, it can affect both your business and personal life. Learn to recognize when sunk costs influence you. Then, apply strategies to mitigate this bias. This way, you can avoid additional losses and focus on actions that align with your objectives and well-being.

Remember – the key is to look forward and base decisions on potential future benefits rather than past costs.