Customer experience (CX) is a critical aspect of any business and a key factor in its success. Yet, measuring the ROI of customer experience initiatives can be challenging.

This article will give you an in-depth look at how to report your customer experience ROI. It will provide you with the best practices for measuring this important metric.

Why is customer experience ROI hard to prove

Customer experience management and measuring CX ROI are difficult. This is because it involves intangible elements like customer satisfaction, loyalty, and trust. On top of that, improving your CX can call for a significant investment of your time and money.

These investments can take time to show results, so it can be difficult to measure your ROI in the short term.

This is because it’s not always easy to link customer experiences to business outcomes. For example, increased revenue, reduced costs, or improved customer satisfaction are good indicators. Yet, it’s hard to link them to a single CX program.

How to report your customer experience ROI

How exactly do you start measuring ROI on CX investment?

Here are the steps you can take to learn how your CX investments are helping your business.

Gather operational and experience data

Before you can measure customer experience ROI, you need to start gathering data. You’ll need operational data (like financial data). One place you can go for this data is your accounting software. You can access the necessary data through advanced reporting features.

You’ll also need customer experience data (such as customer feedback surveys). To access this customer data speak to your marketing and sales teams. Also, refer to your CMS system to gain insights into the customer experience you provide. You can then analyze the data to determine the impact of CX initiatives on your business.

Understand the formula for CX ROI

The formula for CX ROI is pretty straightforward.

CX ROI = ((Benefits – Investments) / Investments) X 100

You can classify many different things as the benefits of your CX initiative. For example:

- How improved customer satisfaction has affected your revenue growth

- Cross-sell and upsell rates

- Customer retention

- Cost-to-serve rate.

Your investments will include:

- Operating costs

- Employee training

- Cost of any new tools or technology

Calculate the benefits and value of your program

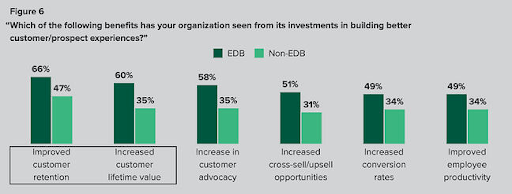

To measure the benefits of your CX program, you’ll need to consider its short and long-term impacts.

Short-term benefits could be direct revenue or improved CSAT scores. Long-term benefits mean factors like increased customer loyalty, reduced customer churn, etc.

You’ll then need a way to link these factors to your CX initiatives. The most common option is to track metrics like CSAT, CLV, etc., over a set period. Some projects will take longer than others to show results, so you’ll have to use your best judgment.

Calculate the operating costs of your program

Think about all the direct and indirect costs associated with the initiative. Direct costs could be employee salaries, software or technology costs, or training expenses. Indirect costs are things like rent, cost of utilities, or general office expenses.

Include future predictions and trends in your report

When reporting customer experience ROI, you should also consider future predictions and trends. This will give you better insight into the long-term impact of your CX initiatives. This is where tools like ecommerce accounting software can come in useful. It offers features such as inventory management and real-time views of your cash flow. These help with forecasting and understanding the future implications of your CX program.

Customer experience ROI metrics

These are the most popular metrics for measuring customer experience ROI:

Customer lifetime value

CLV is a measure of the total value a customer will bring to your business over their customer journey. To work out CLV, use this formula:

CLV = (Average purchase value X Number of purchases per year) X Average customer lifespan

You can extract the data you need to calculate CLV by using your retail accounting software. You can gain an overview of all customer transactions. You can also calculate the average purchase value and the number of purchases per year. This makes it a lot easier to identify your CLV.

CLV gives you a better understanding of the value a customer brings to your business. This works well with your customer acquisition cost. They will give you a clear picture of your available investment margin for CX programs.

Cost per conversion

Cost per conversion measures the cost of acquiring a new customer. Conversion means a customer taking a specific action. And you can define conversion however you’d like in your organization. Just make sure that everyone’s aligned with your definition of a conversion.

This can be anything from buying something to filling out a contact form.

Use this formula to work it out:

Cost per conversion = Total cost of customer experience program / number of conversions

Cost per conversion is a popular metric. It helps you track your outgoings and begin to understand how much you spend to get new customers.

This information can help you make informed decisions about your pricing.

Cost per interaction

This measures the cost of each customer interaction, from a phone call, to an email, to a chat session. Here’s the cost per interaction formula:

Cost per interaction = Total cost of customer support / Total number of interactions

It’s an important metric to consider when evaluating your ROI. That’s because it gives you a clear picture of the cost of each interaction. This helps you decide how much you want to spend on customer support and experience.

First contact resolution

FCR measures the percentage of customer issues you solve the first time they contact you. It’s a useful metric because it gives you an idea of how well your customer service process works.

A high FCR rate tells you that customers are getting the support they need straight away. A low FCR rate tells you that customers are having to reach out many times to get their issues resolved. You can work it out with this formula:

FCR = Number of customer issues resolved during first interaction / Total number of customer issues X 100

Improving your FCR rate reduces the cost of customer support. It also improves customer experience.

Churn rate

Churn rate is the percentage of your customers who leave or stop using your product. A high churn rate can have a significant impact on your revenue growth. It means you are losing customers and potential revenue.

The formula to calculate churn rate is:

Churn rate = Number of customers who leave / Total number of customers X 100

Measure your churn rate when evaluating the ROI of your customer experience program. It will give you insight into your customer satisfaction and how it trends over time.

Getting started with CX reporting

Measuring your customer experience ROI isn’t easy. Yet, with the right analytics, you can get a good idea of the return on your CX investments. Use the data and customer experience metrics we talked about above to get off to the right start. You can perfect your customer experience strategy and gain more satisfied customers.