Your company’s products or services are your raison d’etre (as well as making a profit, of course!).

As the company grows, you add to your product line. The more you add, the more difficult it is to track product performance.

Businesses with many products or services need an effective product portfolio management strategy.

Where do you begin in assessing each individual product? And what makes up strategic portfolio management?

Stick with us. We’ll look at what this is and practical frameworks. Plus, we’ll share tips to guarantee strategic alignment with your business goals.

Understanding product portfolio management

Product portfolios encompass all products and/or services you offer. These could be for sale or via a subscription model such as SaaS.

Product portfolio management (PPM) oversees that portfolio across all the markets you service. It brings together your sales and marketing teams. But it also connects other relevant departments such as the product team.

Collaboration is key here, particularly if you want to achieve short and long-term business goals.

Two factors guide product portfolio management:

- Organizational goals

- The needs of your target markets and customers

One of the main aims is to allow teams to focus on their target market. They then meet market and customer needs quicker (speeding ahead of direct competitors).

It also allows them to offer more value than a business focusing on individual products.

You’re not looking at individual parts. Instead, you’re looking at how the entire portfolio performs. Then you can start digging into how it affects customer satisfaction.

So how does this work in practice?

Managing a product portfolio – an example

Let’s say your business sells inbound call center solutions.

Your main market is the call center sector. But you also sell to other verticals, such as finance, healthcare, and government.

Your product mix covers different features. These might include an IVR system, call barging, and voicemail-to-email transcription. Your portfolio includes all these different solutions.

Enterprises make up the majority of your target market. And they buy through your website or straight from your sales team.

But you want to start learning how to sell on Amazon without inventory. You explore methods such as Fulfillment By Amazon (FBA) to extend reach without the overhead of stock. This could be useful for selling basic products to individuals rather than businesses.

You might also start exploring new distribution models for physical products. That could include a dropshipping approach that minimizes inventory and logistics risks.

Teams then meet to plan your business strategy for the coming financial year. Your product portfolio management plan might look something like this:

- Analyze: This should include a product analysis and market analysis. Look at your entire product catalog. Use everything from legacy data to social listening tools to dig deep. How valuable is each product to the organization? What do metrics like profitability, customer satisfaction, and market share tell you? Is the product performing well? Does it offer potential growth? Look at market trends and other future impacts like evolving tech. These will help you to assess each product’s potential. More importantly, they indicate how well the products fit in with your company’s strategic goals.

- Optimize: Based on your analysis, choose which products to invest in and which to phase out. Consider their value, performance, and future potential. Then allocate resources accordingly. You want to maximize the value of promising products while reducing risks. This ensures the company’s portfolio actively contributes to competitiveness and profitability.

- Align: You want your product portfolio management strategy to be effective. For that, you need to make sure it aligns with the company’s wider objectives. Work with stakeholders to determine goals, target markets, and metrics to measure performance. Look at how to align products to meet those goals. Do you want to obtain more market share? Then perhaps you need to grow your product portfolio. Is the aim to increase profitability? Then consider bundling products or rolling out cross-selling and up-selling campaigns. Now is the time to identify new opportunities and find a balance in your portfolio.

- Govern: This isn’t a one-and-done process. So you need to be clear about who is responsible for what moving forward. Set up processes like regular reviews of the company’s product portfolio and risk assessments. Be clear about what metrics to measure performance against and how to share results. Figure out who the key decision makers are and any criteria for making decisions like which products to invest more in or how to manage risks. Effective management leads to innovation and growth.

Benefits of product portfolio management

Implementing PPM benefits product portfolio managers in several ways:

- Direction. PPM provides a unified strategy for different departments. That includes marketing and sales. But it can also guide your financial planning and analysis (FP&A) strategy. The process digs into product performance. This helps you make decisions on how to divide budgets. If you want to ramp up new product development or product marketing, these insights will help.

- Value. PPM looks at what your customers want and need. That means you can identify and develop solutions that go beyond current offerings.

- Unity. Product management eliminates silos in your organization. Nail it, and you’ll align every relevant team with one overriding agenda.

- Credibility. Every company wants to develop better sales and marketing strategies. PPM helps you do that. The aim is to connect with target customers and identify what motivates them to buy.

- Momentum. To achieve growth, you need momentum. PPM helps you choose which initiatives align with strategic goals. In turn, this speeds up that momentum.

PPM frameworks

Every management strategy offers different benefits. It doesn’t matter whether it’s product management or enterprise architecture management. You have to understand what framework is best for your situation.

Here are three of the main frameworks for product portfolio management. Consider which best suits your business needs and goals.

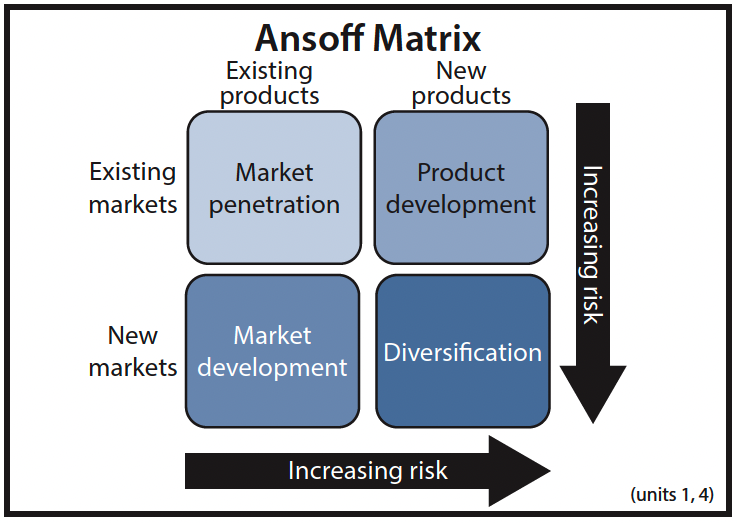

1. Ansoff matrix

The Ansoff matrix looks at the options and risks in making business decisions. It’s most commonly used for product and market expansion.

Any type or size of business can use this model. It doesn’t matter if you’re making your first sale or becoming something of a market behemoth.

That said, it’s best suited to businesses considering new products and growth opportunities. So if you’re launching a product or entering a different market, use this model. It’ll help you figure out the most appropriate growth strategy while gauging the risk level.

For product managers, the Ansoff Matrix is a useful tool for evaluating how to grow a product and which strategies align with business goals.

It helps determine whether to improve an existing product, expand to a new market, or take on a more ambitious pivot. By mapping out potential risks and rewards, product managers can make informed decisions on where to focus development efforts—whether that means deepening market penetration, launching a new feature, or entering an entirely different industry. This model provides a structured way to assess growth opportunities and prioritize product initiatives effectively.

The Ansoff matrix consists of two axes. The vertical one refers to existing versus new markets. The horizontal one refers to existing versus new products.

This matrix creates four boxes that relate to differing strategies:

- Market penetration. Market penetration looks to sell a larger volume of products/services. You’re encouraging customers to buy more or buy more often.

- Market development. This tells you that your organization needs to target new markets. That includes different countries to those you cater to now or new customer groups.

- Product development. This suggests that your current portfolio is not enough, and you need to develop new products. It also suggests your current offerings don’t meet current customers’ needs or wants.

- Diversification. The riskiest of the suggested tactics, this tells you that you need both new products and new markets.

So, what does this look like in practice? Let’s take the example of a secondhand marketplace app.

The company has analyzed customer feedback. They’ve analyzed market trends. They know they have a strong presence and reputation in the market. But customers and trends show a desire for more secondhand pet supplies.

As a result, they create a product development strategy. This matrix is best suited for existing markets and new products. Then, the team starts developing a pet marketplace app to add to their portfolio.and new products. Then, the team starts developing a pet marketplace app to add to their portfolio.

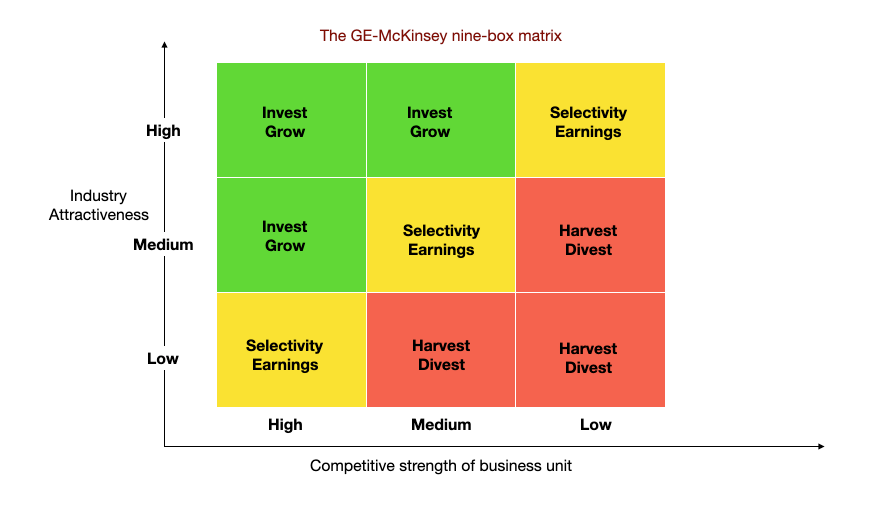

2. GE/McKinsey portfolio analysis matrix

This framework is more complex. It’s best suited to businesses with many product offerings. Large corporations prioritizing growth will also find it valuable.

If you need help figuring out what and where to prioritize, this matrix is for you. Use it to analyze your products so you know which ones are worth investing in. This is an important part of PPM that will help you grow.

The first dimension (or axis) focuses on market or industry attractiveness. In other words, how profitable a particular market or industry is.

This appraises whether your business can enter and/or compete in that sector. It also considers what market opportunities there are.

There are four main factors that decide attractiveness:

- Size of market

- Current and projected growth rate

- Competition

- Market trends and dynamics

The second dimension focuses on the company’s competitive strength. This looks at any advantages your business has and how it is performing. That includes market share and product differentiation.

Your product manager looks at all factors together. Then they plot where a product sits within the matrix. This allows them to check how well positioned your company or product is.

If a product is in the red zone, it’s not worth investing in. It’s not going to be profitable or could even fail. Investing in such a product is a big risk.

The yellow/orange zone is more of a gray area. The choice is up to your decision makers. Selectivity units come with more risk. So they often require a more conservative approach.

Green is where the magic happens. These products show promise. They’re performing well and are in an attractive market. That means they’re primed for growth. You have the green light to start allocating resources and capital. Give them an even bigger boost!

Are you a large business with a diverse product portfolio? Then this framework may be ideal for your product manager.

Much like you carry out an application inventory, this looks at your entire portfolio. It looks at your market share and market growth rate.

The idea is to test your portfolio’s performance. This allows you to find areas where you should assign resources. It’s particularly useful when it comes to long-term planning. Categorizing products in your portfolio gives you the power to create strategies for them.

To use a BCG matrix, you’ll need access to performance data. That includes sales volume, ROI, growth, and share of the market.

If you use a Square or Magento POS system, use this to locate product data. You can also find data in your ERP software.

Use these metrics to place your products into one of the four quadrants:

- Stars. These are items in your product line that generate high revenue and profit. Invest in them to maintain growth and see an increase in their market share. If you balance it right, stars will become cash cows.

- Cash cows. An existing product that produces a consistent cash flow is a cash cow. It often supports other products, too. Cash cows are in low growth areas but bring in high returns. As such, they’re self-sustaining. Milk them! Use your cash cows to generate capital to invest in stars.

- Question marks. As the name suggests, these products come with a degree of uncertainty. It may be a new product or only have a small market share. You may have questions around product performance. But you hope it grows with investment and effort. Keep a close eye on these products. Analyze them regularly. Do they still align with your goals? Should you invest more in them? A question mark product could become a future star or you might drop it altogether.

- Pets. A pet (or dog) is a single product with a small market share and ROI (return on investment). It may also have no or limited growth potential. You have to decide whether pets are a strategic fit. Most of the time, they’re not. And you don’t want them sucking up all of your funds. Phase them out or divest them to another organization.

5 product portfolio management tools

So, what tools will help make your PPM strategy more effective? Here are five worth considering:

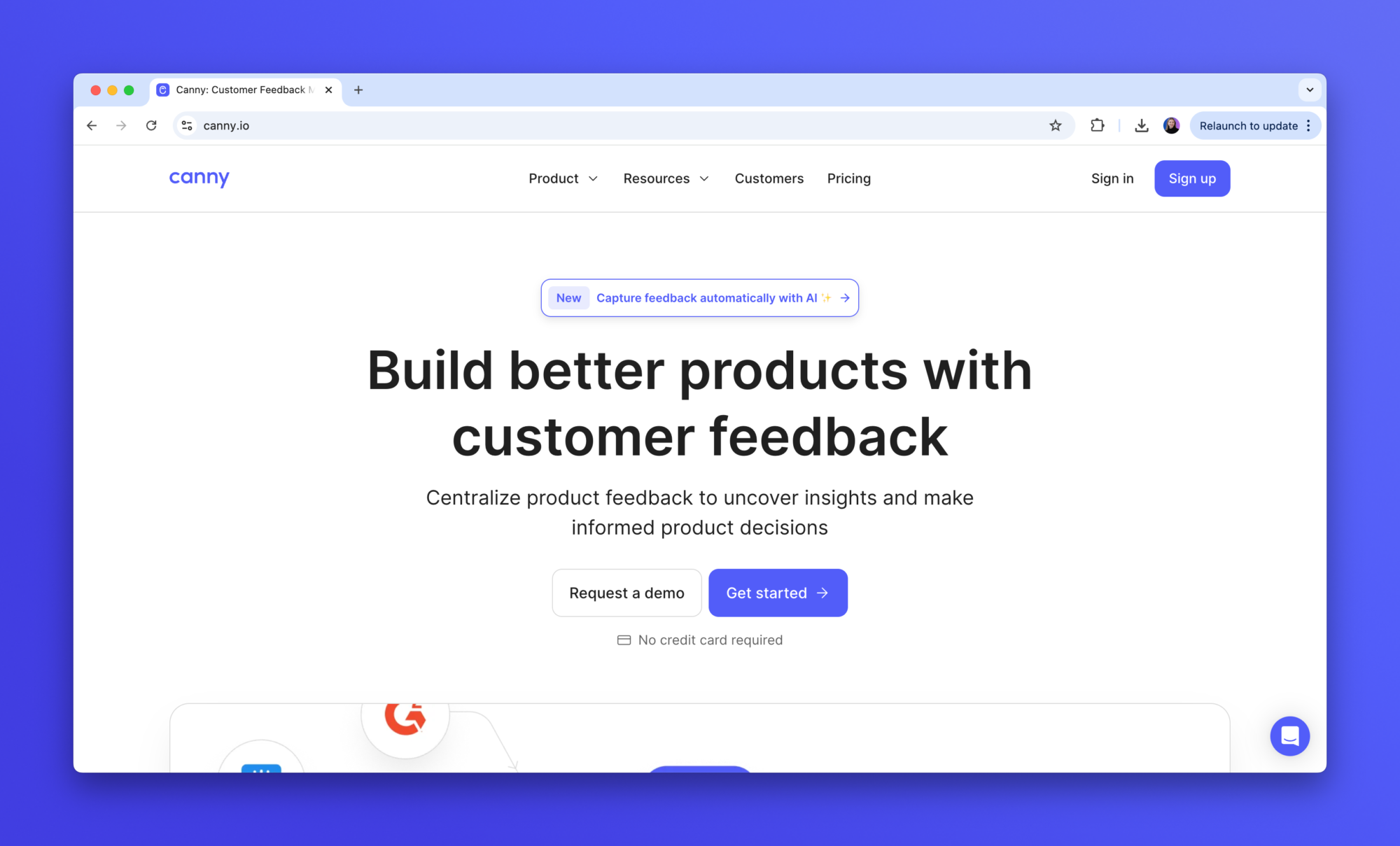

- canny.io. Canny is a product feedback platform. It’s ideal whether you have lots of products or digital ones like enterprise search solutions. Use it to get feedback on each of your products. Then use that feedback to prioritize products and grow your portfolio. The platform integrates with other tools like Zapier, Slack, and Salesforce. This centralizes all product data and customer interactions for better insights.

- Monday.com. Project management is an important part of portfolio management. Monday is great for keeping everyone aligned. The platform gives you a central location for managing projects and collaborating with different departments. Use it to create projects for each phase, such as analyzing your portfolio and creating strategies. When you implement a framework, Monday will also help you communicate with decision makers.

- Quickbase. Perfect for organizations with complex projects. Quickbase allows you to centralize product data from different sources. The platform is useful if you deliver physical products and services. You can track and coordinate delivery by connecting different teams involved.

- Triskell. An enterprise PPM platform that’s ideal for alignment. The software lets you link objectives and portfolios from across the company. Its New Product Development software is particularly useful. Use it to manage resources and budgets from the ideas stage to launch.

- Palma. This modular management tool simplifies the product process. It also gives all stakeholders a unified place to view portfolios. You can import product architecture and data. This allows you to analyze the profitability of your product portfolio. It’s also useful for introducing and updating products.

Choose the tools that make sense for your portfolio and goals. Make sure they integrate with existing ones in your tech stack.

Product portfolio best practices

The size of your portfolio is almost irrelevant. You still need to follow a few best practices to get the best from your strategy.

Existing products

Audit your existing products as part of your product portfolio strategy.

Analyze the performance of each one. Look at historical data to find trends such as seasonal fluctuations. This can help you make those hard decisions when it comes to dropping a product from your portfolio.

Sales figures are a great starting point. But look at the other factors involved in a product’s success, too. That includes resource allocation, total costs, customer feedback, and staff involvement.

Determine objectives, such as selling X units in a given period. It’s worth setting a sales figure you want to achieve. But don’t forget about profit margins and other factors. These also determine whether a product contributes to your portfolio.

As you work through and score products, don’t look at finances in silo. Yes, factors such as development cost versus predicted and actual returns are important. But you also need to think about a product aligning with your business’s goals and values.

If a product is borderline and you decide to keep it, that’s fine. But revisit it by conducting another product analysis later.

You might choose to adjust the pricing or market it another way. Shifting your product strategy could turn a pet into a star. But even stars need to align with the company vision.

New products

When it comes to new products, you won’t have historical data at your fingertips. But chances are you’ve done some predictive forecasting. It’s worth doing this to gauge the likely success of a product as part of a go-to-market strategy.

If you haven’t already, run a strategic analysis. This checks product risk and whether they’ll cover development and production costs. Look at each new (or planned) product and find a balance between opportunity and risk. What demands will an individual product place on your resources?

With anything new, focus on higher-value products. That is, unless you flag them as high-risk. High-value products that sell well drive your revenue.

Once you introduce a new product, give it plenty of support. Test it over the first year to make sure the results meet your predicted expectations.

The takeaway

If your company sells more than a handful of products, you need a product portfolio strategy. Whether you’re an omni-channel retailer or a SaaS provider is irrelevant.

Your strategy shapes everything: How you market your products. What new product lines you roll out. Where you put your resources.

It also ensures your products are in line with customer preferences and expectations.

The strategy you choose has to align with business objectives. You can then look at what product lines offer the best ROI and prioritize products as needed.